Exploring Personal Loan Options in New Zealand

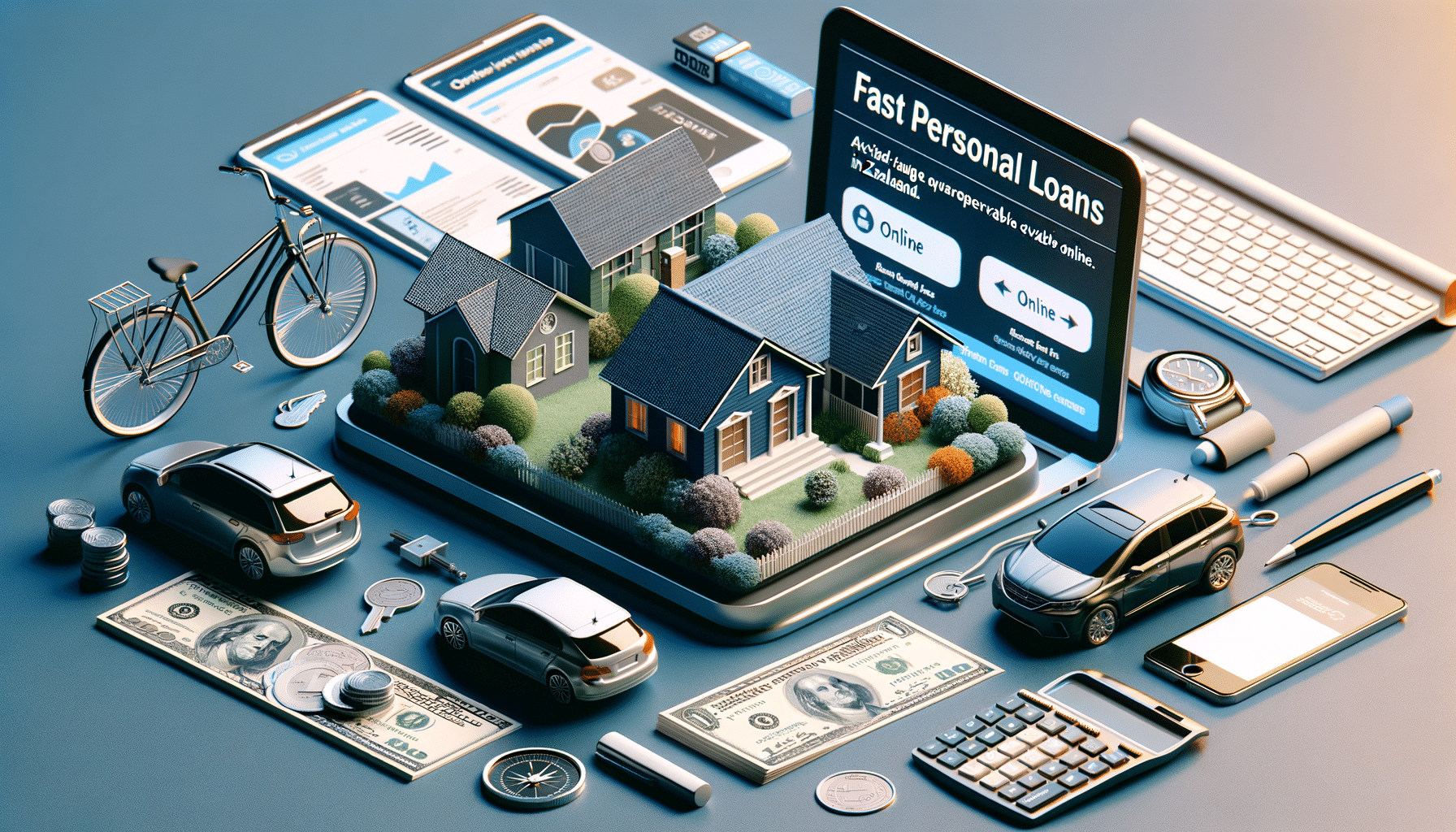

Understanding Fast Personal Loans in New Zealand

In today’s fast-paced world, the need for quick access to funds can arise unexpectedly. Fast personal loans in New Zealand are designed to meet such urgent financial needs. These loans are typically characterized by a streamlined application process, swift approval times, and rapid disbursement of funds. They are particularly useful for covering emergency expenses, such as medical bills or urgent home repairs.

One of the key advantages of fast personal loans is their accessibility. Many lenders offer online applications, allowing borrowers to apply from the comfort of their homes. The process usually involves filling out a simple form and providing necessary documentation, such as proof of income and identification. Once approved, funds are often transferred to the borrower’s account within 24 to 48 hours.

However, it’s essential to consider the interest rates and terms associated with fast personal loans. Due to the convenience and speed, these loans may come with higher interest rates compared to traditional loans. Borrowers should carefully evaluate their repayment capacity to avoid financial strain. Despite the potential for higher costs, fast personal loans can be a valuable resource for individuals in need of immediate financial assistance.

Exploring Personal Loans in New Zealand

Personal loans in New Zealand offer a versatile solution for various financial needs, from consolidating debt to funding major purchases. These loans are typically unsecured, meaning they do not require collateral, making them accessible to a wide range of borrowers. The flexibility of personal loans allows individuals to use the funds as they see fit, whether for home improvement projects, education expenses, or even travel.

When considering a personal loan, it’s important to compare different lenders and their offerings. Factors to consider include interest rates, loan terms, and any additional fees. Many financial institutions in New Zealand provide competitive rates and flexible repayment options, allowing borrowers to tailor the loan to their financial situation.

Moreover, personal loans can help improve credit scores when managed responsibly. Timely repayments demonstrate creditworthiness, which can be beneficial for future borrowing. It’s crucial to understand the loan agreement fully and ensure that the monthly repayments fit comfortably within one’s budget. By doing so, borrowers can leverage personal loans to achieve their financial goals without undue stress.

The Convenience of Online Personal Loans in NZ

The rise of digital banking has made online personal loans in NZ an attractive option for many borrowers. These loans offer the convenience of applying from anywhere with internet access, eliminating the need for in-person visits to a bank. The online application process is typically straightforward, with many lenders providing instant decisions based on the information provided.

Online personal loans are not only convenient but also offer competitive rates and terms. Borrowers can easily compare different lenders online, ensuring they find a loan that suits their needs and budget. Additionally, online platforms often provide tools and calculators to help borrowers understand their repayment obligations and manage their finances effectively.

However, it’s important to remain vigilant when applying for online personal loans. Borrowers should ensure they are dealing with reputable lenders and understand the terms and conditions of the loan. By taking these precautions, individuals can enjoy the benefits of online personal loans, such as quick access to funds and flexible repayment options, while avoiding potential pitfalls.